This article has been reviewed and updated with current information, new examples, and the latest academic requirements for 2025

Leasing a car might seem like a good idea, but it’s not always the best choice. There are several reasons not to lease a car, such as mileage limits and extra fees. You won’t own the car and may end up paying more in the long run without getting any value.

If you are interested in getting a new car, leasing a new car can appear to be a prominent option. When you take a car on lease, you make payments to drive the car for a stipulated period. However, when you purchase it, you spend your money to take its ownership. Leasing helps you to use a new car during the tenure of the lease agreement and return it on the expiry of the lease period. However, the purchase is a one-time agreement with the car retailer and manufacturer for its lifetime ownership. Taking a car on lease often seems to be more beneficial. However, we suggest against it. If you are intrigued to learn the reasons not to lease a car, read this blog. Here we have laid down 10 reasons and also shared the difference between a lease and a purchase, and many other related details.

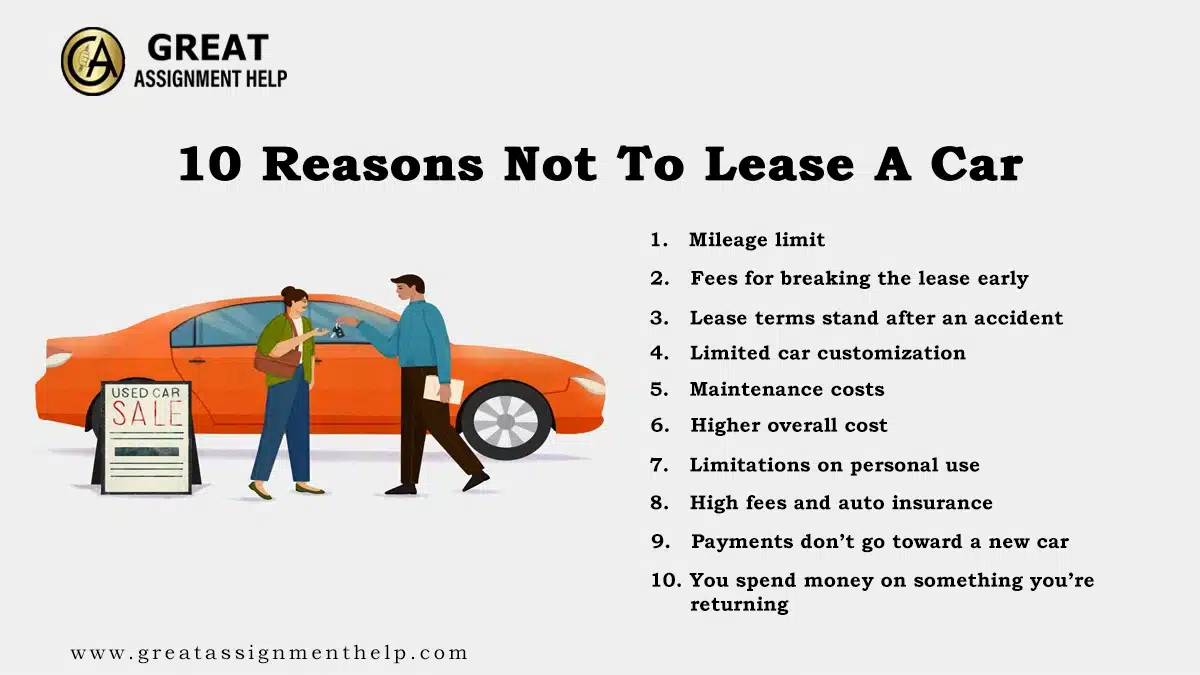

10 Significant Reasons Not to Lease a Car

Deciding whether to buy or lease a car is a big decision, and what works for one consumer may not work for you. As with any purchase of a product, it is imperative to consider the pros and cons of every situation. Before you decide to buy a car on a lease, consider these downsides first.

1. Mileage limit

The first reason why we suggest not leasing a car is the mileage limit. Most lease contracts allot you a specific number of miles up to which you can drive the car each year. If you run your car beyond the assigned mileage during your lease period, you will be billed extra mileage fees. These mileage boundaries are set by the leasing company.

For someone who does not drive much, this might not appear to be a big deal. But if you drive to and from work every day, you might hit upon the mileage cap as a roadblock.

2. Fees for breaking the lease early

The conditions of the lease usually span a couple of years. During the leasing period, you must pay the monthly leasing fee. If you have made up your mind that leasing a car is no longer helpful for you, you may think about putting an end to your contract early.

Unfortunately, settling on terminating the leasing agreement before the expiry of the lease will leave you with a huge bill payable to the leasing company. You can anticipate spending money for the remainder of the owed balance on the automobile lease, in addition to large untimely termination fees.

3. Lease terms stand after an accident

The other reason not to lease a car is that the lease terms stand after an accident. If you go through an automobile accident and the car is completely damaged, you still have to complete the terms of the auto lease. Gap coverage can aid in covering these expenses, but devoid of it, you will be left paying a huge sum to the leasing organization for an automobile that you cannot operate.

4. Limited car customization

When you own your car, you may have the benefit of modifying it to your taste. This could incorporate window shade, car magnets, bumper labels, or even operation-enhancing changes. When you take a car on a lease, there is a limit to how you can customize the car. This includes car modification to improve the automobile’s performance. The dealer looks forward to the car coming back in the way it was originally leased, with only predictable wear and tear. It is the other significant reason why we suggest not leasing a car.

5. Maintenance costs

Another significant reason not to lease a car is the risks associated with the maintenance and repair of the automobile. The car must be given back in the same condition as it was initially leased. During the tenure of your lease term, you are accountable for paying maintenance costs. There is some wiggle room for usual wear and tear, but if the car is sent back with additional wear at the time of submission, you could be knocked down with supplementary fees and fines.

6. Higher overall cost

Compare the costs of monthly payments for taking a car on lease with the monthly installments you have to pay to buy a car through a car loan. It may first appear that people are misguiding you with the reasons for not leasing a car as the cost of monthly lease bills is much lower than that of the purchase installments.

However, in most cases, in the long run, leasing a car will be more expensive compared to buying a car and putting money into it with a car loan. The primary reason is that you are only paying for the utilization of the automobile throughout the lease term instead of the entire worth of the vehicle.

7. Limitations on personal use

Some leases may have limits on how you can make use of the vehicle, such as limiting commercial use or putting a ceiling on the kind of roads you can drive on. In general, leasing a car often presents less flexibility than having possession of a car, as you may be on the threshold in terms of the extended amount of time you can possess the vehicle and what you can do with it.

8. High fees and auto insurance

Car insurance premiums tend to be higher in cases of leases. Additionally, depending on your country or locality’s requirements, you may have to pay more to index a leased car. The insurance company and registration costs can put quite a lot of bills ahead of your lease cost.

9. Payments don’t go toward a new car

Leasing a car indicates you use it for a period according to the lease terms, and then return it. In short, upon completion of the leasing period, you gain nothing. Instead, you have to make a fresh start with a separate car, which comes with new lease regulations. Cars are taken into account as assets. But, when you take it on a lease, you do not add it to your wealth or develop equity in your car.

10. You spend money on something you’re returning

The final reason for not leasing a car is that leasing a car signifies that your money is not put in wisely because it is only heading for lease payments. The car is not your property, and therefore cannot be exchanged or utilized to buy another car. You pay to drive the car for the period of your lease, not to get hold of ownership. Not unlike renting, leasing a car involves using up thousands of dollars on an object that is not yours.

Additionally, when returning your car after the lease term expires, you may be liable for a lease disposition fee. This is the handover fee, which is a fund that covers any clean-up the merchant has to perform to bring the car back to its original condition.

Also read: Significant Reasons Why Homework Is Bad

Leasing vs. Purchasing: Which is More Profitable?

The method to lease and buy a car is similar, but there are some important differences between these two options. Once you know the pros and cons of buying compared to leasing a car, it can help you determine which option works best for your needs.

Pros of Leasing a Car

The following are some benefits of leasing a Car

- Get a diverse car on each lease term

- Does not mandate a down payment

- Lower monthly fees than buying a car

Cons of Leasing a Car

Find here the drawbacks of leasing a Car.

- Must return the car at the end of the term

- Typically, more expensive in the long term

- May need to pay additional fees if the car takes on more wear and tear

- Mileage cap

Pros of Buying a Car

Listed below are some advantages of buying a Car

- You possess the car after paying the loan installments

- Usually economical in the long run

- Doesn’t matter how long you drive it or how much wear and tear it goes through

Cons of Buying a Car

The following are some drawbacks of buying a Car

- Have to stick with one vehicle until you trade it in or sell it

- Higher monthly payments

- Typically requires a down payment

Leasing vs. Buying a Car: Comparison Table

| Basis of comparison | Leasing | Buying |

| Possession | The company that takes a monthly fee against putting the car on lease is the owner of the company. | You own the car |

| Monthly payments | The monthly payments you make for taking a car on lease are much lower than what you pay to buy the car. When you make payments for taking a car on a lease, you pay the principal amount and the interest. The leasing company makes more benefits from the principal amount you pay instead of you. | Payments made to buy a car are typically higher than a lease. Payment is made towards the principal and interest of buying the vehicle on a loan |

| Mileage | One can drive a vehicle for a limited miles. Plus, additional fees must be paid for driving over the limit. | Unlimited mileage |

| Maintenance/Wear and Tear | You are accountable for all maintenance. Moreover, you must pay fines for additional wear and tear or lack of maintenance of the car. | You have to take the responsibility for the maintenance of the vehicle, but you must not worry about wear and tear |

| End of term | You can put an end to the contract of lease and stop taking a car on lease from the company. If the lease agreement mentions it, you can buy the car as well. However, if you wish to use the car on a lease, you can renew your lease by paying some fees or buy another lease for a different car. In both cases, you will have to make the payments. | At the end of the term of the loan interest payment, you are free to use the car as your own without any need to make any payment to the financing company. |

| Future value | The value of the vehicle depreciates, but it does not impact you financially. However, you do not have any equity in the vehicle either | The value of the automobile will depreciate, but its cash value is all yours |

Details Included in a Car Lease Deal

A car lease is a contract that describes the terms and conditions that are laid down by the leasing organization. It primarily consists of details related to the following items:

- Permitted mileage up to which the car can be used

- Length of time for which the lease is applicable

- Payments are to be made in the following cases:

- each month

- at the time of taking the acquisition of the car on a lease

- early termination

- after the completion of the leasing period

- surplus wear and tear

- maintenance of the car

Information related to the extension of the leasing period, purchasing the car, and returning it is also included in the agreement.

Credit Score Requirements

There are credit scores for getting a car on lease. When a credit check is performed by the business organization, it will be ascertained if they want to take on the monetary risk of giving the user a car lease.

If you have low credit, there is a possibility that you will be assigned a used car to take on lease.

Is it a Good Idea to Lease a Car?

We have highlighted several reasons not to lease a car. However, some people can benefit from it. The following are the 3 circumstances when leasing a car can be a good idea:

- Want to buy a new car every year

Some people have a fascination with new cars. They want to drive the latest models of top brands every year. If you are one of them, leasing a car can be helpful for you.

- Have a tight budget

The monthly leasing fees are significantly lower compared to the cost of buying a car.

- Enjoy tax deductions

Many countries offer tax deductions to self-employed small businesses if they use cars for business purposes on lease.

Also read: Get to Know the Significant Differences Between Float Vs. Double

What to Know Before Leasing a Car?

When you consider car leasing as a method to get your subsequent vehicle, there are a few things to mull over before putting your signature on the contract. To begin with, putting money aside for a down payment may assist in reducing the amount you need to spend on a lease. A down payment may not be necessary, but it can assist you in saving money on monthly costs.

It is essential to be acquainted with the general cost of the car throughout the lease agreement. This is because monthly expenditure has a propensity to be lower than putting money into a car or a car loan. It may be enticing to take the plunge before reading the fine print.

Conclusion

The above discussion highlights the reasons not to lease a car. You will have to pay a lot more money on the whole for taking a car on lease, and the mileage limit set by the car leasing company will not allow you to utilize the car to its optimum capacity. None of these is beneficial for the user. If you are still unhappy with these points and looking for more explanation, get in touch with our assignment help experts. They can help increase your knowledge of and solve your queries.